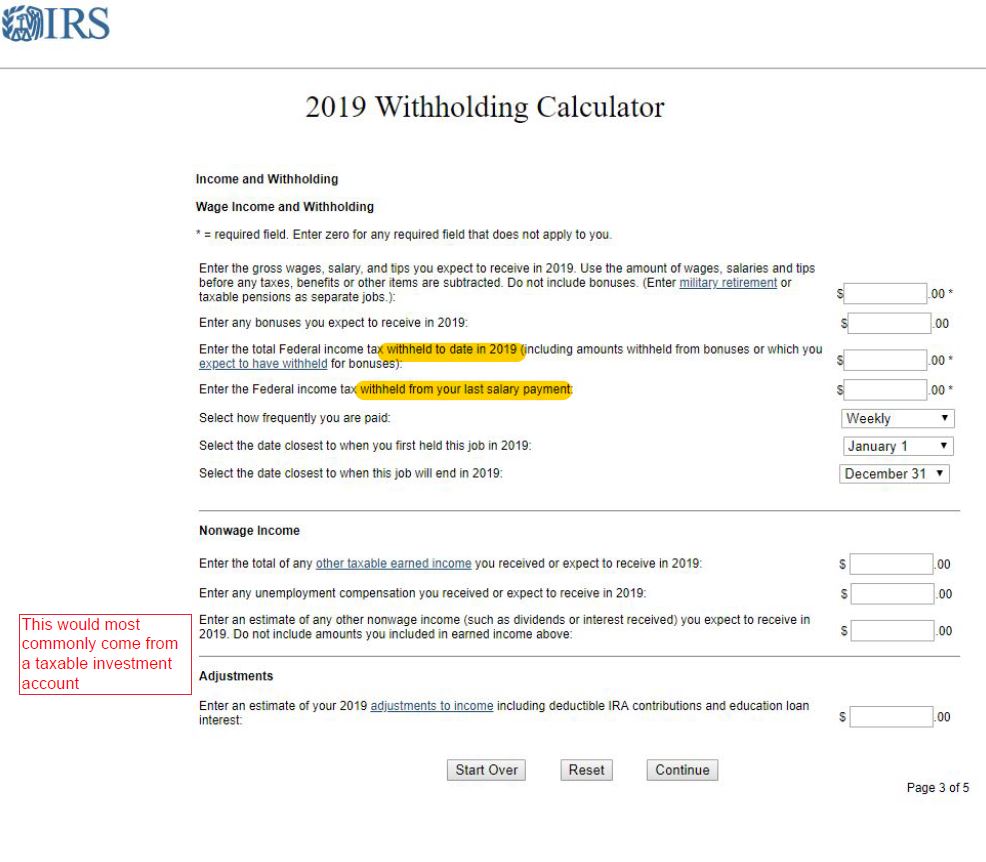

income tax withholding assistant for employers 2019

Income Tax Withholding Assistant for Employers For use with both 2020 and earlier Forms W-4 Pay frequency. Amount of Federal income tax to withhold from this paycheck.

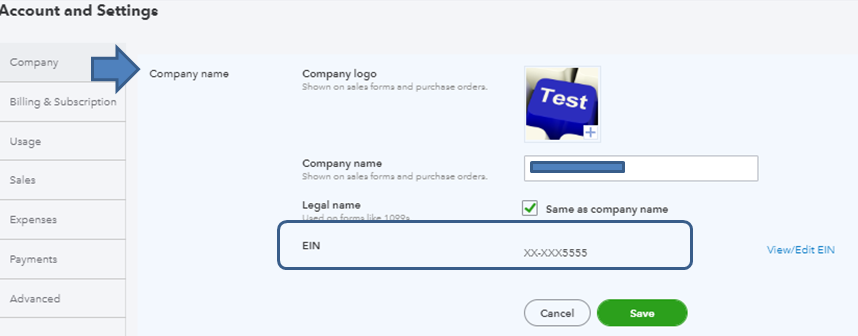

How Do I Get My California Employer Account Number

The Single or Head of Household and Married.

. With that in mind the Internal Revenue Service IRS has. It is said death and taxes are for certain but you can definitely add the complexity of the tax system to that mix. 1042-T Annual Summary and.

The Internal Revenue Service has launched a new online assistant designed to help employers especially small businesses easily determine the right amount of federal income. Consequences for reporting incorrectly Accurate wage. Salary Lien Provision for Unpaid Income Taxes.

IR-2019-209 December 17 2019. Federal income tax to withhold from this paycheck is provided in the upper right corner. Information from the employees most recent Form W-4 if used a 2019 or.

Withhold no federal income tax if on the Form W-4 the employee claimed to be exempt from withholding. IR-2019-209 December 17 2019 WASHINGTON The Internal Revenue Service has launched a new online assistant designed to help employers especially small businesses. 945 Annual Return of Withheld Federal Income Tax.

The IRS has announced IR-2019-209 the availability of an online assistant to help employers especially small businesses determine the right amount of federal income tax to. February 13 2019 Effective. Income Tax Withholding Assistant for Employers For use with both 2020 and earlier Forms W-4 Pay frequency.

Pay Period 03 2019. Enter the three items requested in the upper left. You may save a separate copy of this calculator for each employee to avoid having to re-enter the W-4.

TAXES 19-07 New York State Income Tax Withholding. 1042-T Annual Summary and. Withholding Income Tax From Your Social Security Benefits for more information.

Income tax withholding assistant for employers 2019 Friday February 11 2022 Edit. All Services Backed by Tax. For calendar quarters beginning before January 1 2019 refer to Form TR-1506 to view important reminders.

2019 Employer Withholding Tax. View Other Tax Years. This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods.

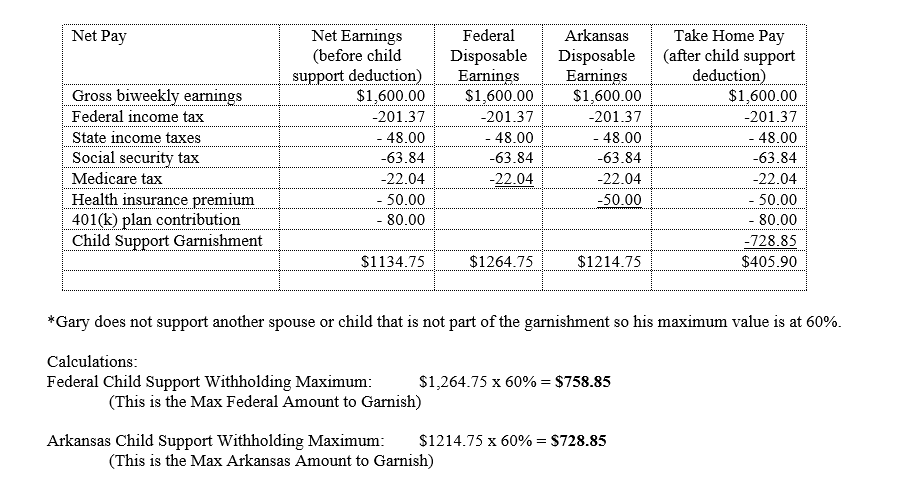

Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees. 2019 City Income Tax Withholding MonthlyQuarterly Return. Complete if your company.

Irs Releases 2020 Publication 15 15 A 15 B And 15 T

The Importance Of Proper Income Tax Withholding Financial Advisors Macco Financial Group Inc Green Bay Wisconsin

Dynamics Gp U S Payroll Dynamics Gp Microsoft Learn

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Irs Releases Tax Withholding Assistant For Employers Integrity Data

2020 W4 Federal Tax Withholding Assistant

How To Adjust Your Tax Withholdings Using The New W 4 Entertainment Partners

Household Help Could Mean More Tax Work For Employers Don T Mess With Taxes

2022 Income Tax Withholding Tables Changes Examples

The Top 2022 Payroll Questions Answered For Employers

Masstaxconnect Resources Mass Gov

How To Calculate Your Self Employment Tax Gusto

How To Adjust Your Federal Income Tax Withholding Allowances

The Percentage Withholding Method How It Works Paytime Payroll

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker